Hands up who finds downloading your monthly subscription invoices or supplier bills from online portals a pain? I know I do! The time involved with logging on, downloading and then saving to folders is time that could be better spent. So, when Receipt bank told us about Invoice Fetch, we were all ears. Invoice Fetch […]

Category Archives: Uncategorized

Aesthetics businesses beware! The botox treatments you think are exempt from VAT could in fact be classed as purely cosmetic and land you in hot water with HMRC. And we’re not just talking botox. As you probably know, you are exempt from charging VAT for treatments if there is a medical purpose to those treatments […]

2020, what a year. Its not every year that a pandemic puts a halt to life in such a devastating way. But 2020’s not been all bad. In fact, I’d say that CDC has had its most memorable and most positive time and I can definitely say that staring in Facebook lives and running workshops […]

I’m not talking about taking the tinsel down and putting the Christmas tree away. I’m talking tax! The deadline to complete your tax return is looming and around 5.4 million Self-Assessment customers have until 31st January to complete their tax return. HM Revenue and Customs said they expect 12.1 million tax returns to be filed this […]

Good news! Self-employed workers who are yet to submit their tax return were given a late Christmas present as of (Monday, 25th January) – an extra month to fill it out! HM Revenue and Customs said that self assessment customers will NOT receive a fine for missing the 31st January deadline, as long as they file […]

All employees are entitled to holiday pay, so employers must calculate it for all their workers, but that’s not so easy for those without fixed hours or pay. Holiday pay must be paid, because workers should not suffer financially for taking holiday, so it is important to understand the process. Unless a worker is self-employed, almost […]

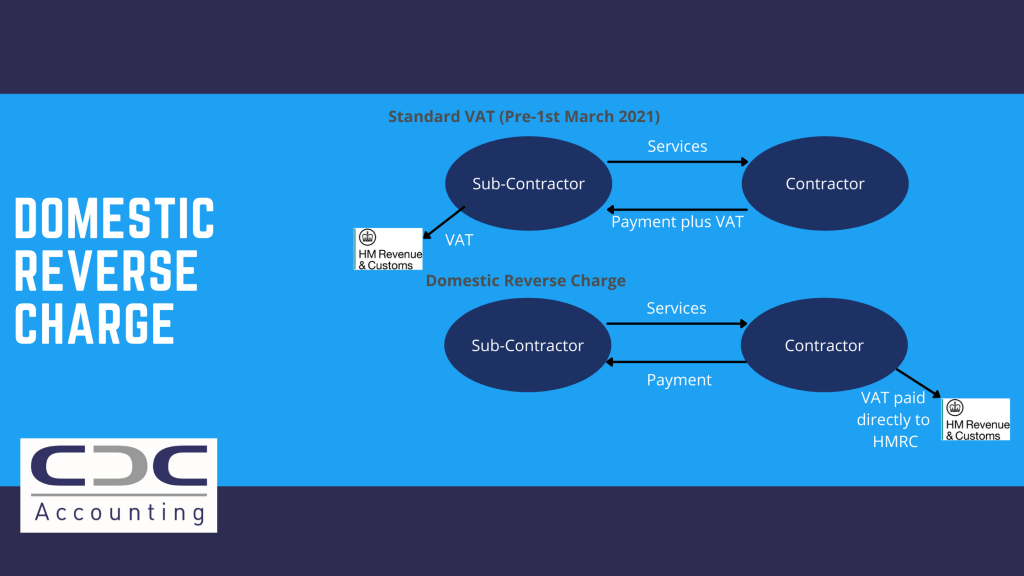

HMRC have introduced a new VAT legislation for the construction industry which comes into effect today (1st March 2021). Domestic Reverse Charge or DRC is a new way of accounting for VAT and will apply to all VAT registered construction businesses in the UK. To sum up what this means, the Vat liability moves from […]

Pay VAT deferred due to coronavirus (COVID-19) Did you defer VAT payments last year? If so, now is the time to decide whether to pay in full or join the VAT Deferral New Payment Scheme service. The service is open online now and you can choose to join it (opt-in) and pay your VAT in instalments. […]

Electric Vehicles (EVs) are the current hot topic. Fueled by the guilt that is laid on us about the effects of human damage to the planet, and the climate crisis. Then there’s the government’s target to phase out the sale of all new petrol and diesel cars by 2040, and for most cars to be […]

There are many factors that can impact business. We have seen that this year with the effect of COVID on all businesses, big and small. Hopefully, the chances of COVID happening again are slight, but there are disruptions that could (and do) happen, that have just as devastating an effect on your business. HMRC haven’t […]