The UK Governments Job Support Scheme

The Job Support Scheme is designed to protect viable jobs in businesses who are facing lower demand over the winter months due to Covid-19, to help keep their employees attached to the workforce

What we know so far

We know the scheme will run for 6 months, from 1st November – 30th April 2021. Its aimed at small and medium sized businesses, regardless of whether they have used the furlough scheme previously.

The scheme is designed to promote shorter hours working for existing employees. So if an employee can work for at least 1/3 of their normal hours, their job will be classed as viable and therefore eligible for the scheme.

How will it work?

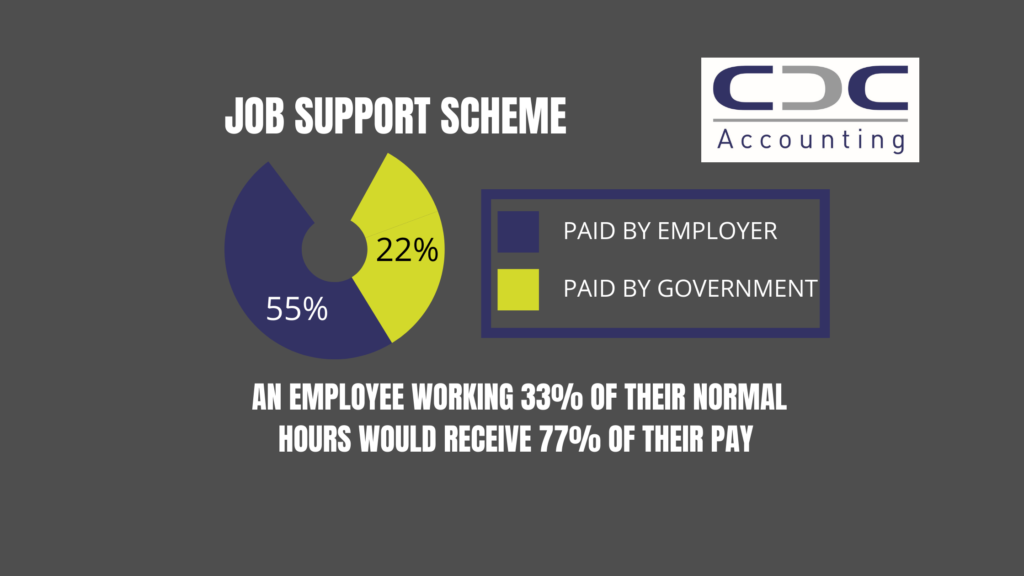

You will pay them for the hours they work as normal (this must be at least 1/3 of their normal hours. The government will then Share the financial burden of the lost hours with you and the employee. So, the government will reimburse you half the cost of paying to the employee a further 2/3 of the pay they have lost working reduced hours.

Employer will pay 55% of normal salary, Government will cover 22%, meaning the employee will end up with 77% of normal salary.

What are the restrictions

These are the restrictions on the government contributions:

- Government contributions are capped at £697.92 per month

- They will not cover NI or pension contribution elements, so these will remain payable by you

- The employee cannot be made redundant or put on notice of redundancy during the time you are claiming the grant for that employee.

The government contributions will be paid in arrears. After 3 months or from February 2021, the government will consider whether to increase the minimum 33% hours threshold

You can also continue to claim the jobs retention bonus if you are eligible at the same time as the job retention scheme.

What about the self-employed

The chancellor has also announced a similar package of support to the self-employed, as well as further assistance on deferral of payments to tax and loans.

What we do not yet know.

We recommend waiting for the detailed guidance before making decisions on whether to make use of the scheme. Its clear that the level of support is substantially lower than the 80% of the original furlough scheme, with a maximum of 22% support and the restrictions listed above.

Where you have a reduction in business demand currently, which you expect to pick up again once Covid restrictions are eased, then it might be worth considering. If your employees were furloughed, then you also have the additional incentive of the job retention Bonus.

Another consideration is the financial comparisons of having fewer full time staff working for you, or more staff on shorter time working, and whether the financial incentive and the ability to retain valued staff is enough to join the scheme.

We assume the guidance will offer a clearer picture of what might happen in practice. There is some indication that you will be able to bring employees in and out of the scheme depending on your and their circumstances, for periods of 7 days or more, but we don’t yet know how this will work with self-isolation requirements, for instance.

It also seems that employees can be moved out of the scheme during the 6-month period in order to be made redundant, so it may not involve a complete ban on redundancies.

Annual leave during furlough has been important for many of you, and at the moment we would assume that this scheme will be the same and holidays will continue to accrue at the full-time rate, but as this is a longer term change it might be treated differently – although perhaps that is unlikely?

Its also not clear now what happens with regards to the missing one third wages. We presume that you will need to negotiate a reduced pay with the affected employee (as with furlough). It is also not clear whether it will be open to employers to ‘top up’ the pay to 100% as before.

What we’ll do to support you

When the government provides the detailed guidance, we will update you. We will also aim to support your calculations as we did through furlough.

As always, for all your questions and concerns you can contact myself or any member of my team and we’ll do our best to address them.

Email me Chris@cdcaccounting.com, or call the office 01978 861196